September marked a change in the Toronto residential marketplace. For the first time since April, the average sale price for all properties sold in the Greater Toronto Area rose.

In September, the selling price for Toronto homes averaged $809,591. This equates to 11% higher than August and 5.62 percent higher than September 2016. This is a good sign and the first step to the resale market’s return to normalcy. It’s certainly better than the frenzied market we experienced between January and April.

Have a read below for full details on the current state-of-the-market, but if you just want a summary – here it is:

- Lack of inventory is no longer a challenge for buyers

- Sellers need to be realistic with their pricing if they hope to sell

- Buyers have more time to make a sensible purchase

- The new mortgage “stress test” will impact the market… only time will tell to what extent

- The market, on the whole, is normalizing

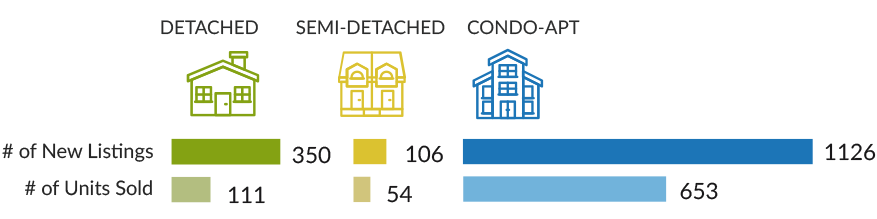

Over the last 5 months, the market has moved from an insane seller’s market to a more nuanced, balanced market. At the end of September, there were 19,021 properties available to buyers, a stunning increase compared to the paltry 11,255 available last year. In percentage terms, availability has increased by 69 percent, year-over-year.

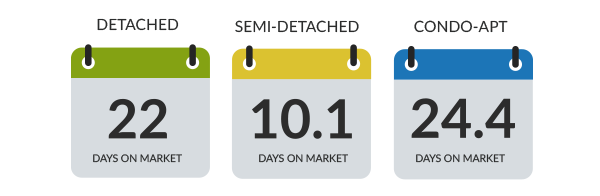

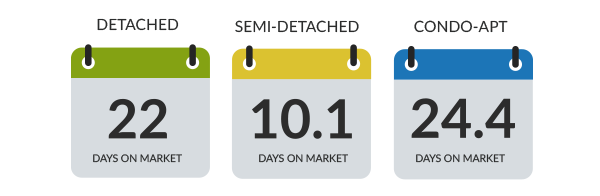

Needless to say, with an increase in supply, both average days on the market and months of inventory have increased dramatically. Year-over-year days on market have increased from 16 to 24 days.

Sellers hoping for the heady days of January through April will be disappointed. In addition to assimilating the impact of the foreign buyer’s tax, the Toronto market has had to contend with two quarter-point mortgage interest rate hikes, with (potentially) more to come, as well as the introduction of stress-testing which begins on Jan. 1st, 2018. All of these factors will serve to moderate the residential resale market for the foreseeable future.

If you’re thinking about selling or buying, bear one thing in mind: your circumstances are unique. While I can share industry averages and figures with you, the reality is that everyone has different expectations for selling or buying. The best way to prepare yourself to enter the market is to speak with a professional who knows the GTA. If you’ve got questions or are just curious, reach out to me today: 416.566.77630 or susanbandler@chestnutpark.com

I’m happy to help you determine the best way to strategize for this transitional market.

{BY THE NUMBERS}

{BY THE NUMBERS}

{FROM MY BLOG}

{FROM THE BLOG}

Mortgage Approval Rates are About to Change

As of January 1, 2018, many buyers will be subject to a new “stress test” to qualify for a mortgage. Click here to see how purchasers will be impacted.

Has the time come for Smart Roads?

Between Kansas City exploring sensor-laden roads, and Google’s Sidewalk Labs preparing to build a ‘smart-city’ on Toronto waterfront, the possibility of driver-less cars is starting to get very real. Read More…