There were no surprises in the the May real estate market. But, three themes did emerge:

- The city’s resale market continues to strengthen in the 416 region

- The 905 region continues to lag behind the overall market

- High-end resales ($2 Million+) has yet to return to its first-quarter performance in 2017

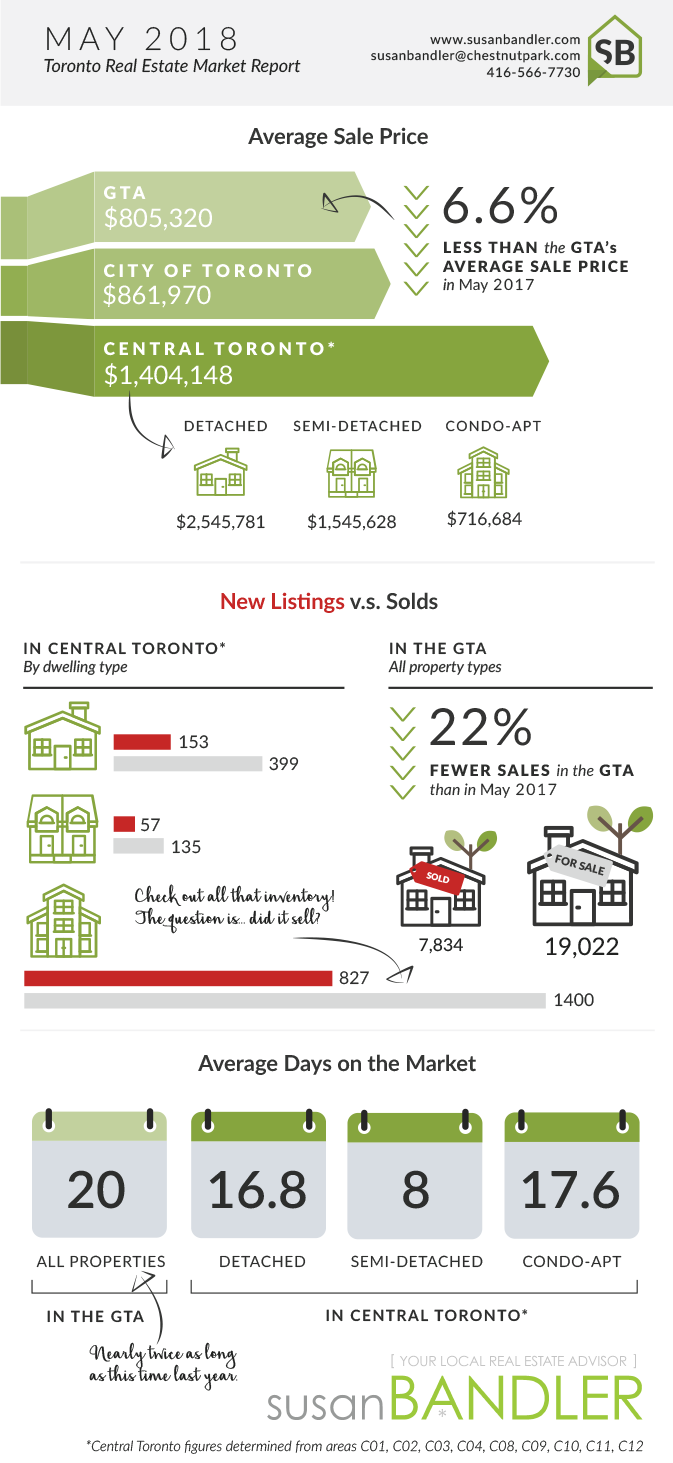

The City of Toronto has just about returned to its 2017 figures. The average sale price for all properties came in at $861,970 compared to $899,000 for last year. This number includes condominium apartment sales which continue to represent Toronto’s most affordable housing; this segment accounted for more than 56 percent of all properties sold in May.

The sub-$2 Million market is chugging along just fine, while the upper-end is struggling. A total of 233 properties with a sale price over $2 Million were reported sold this May. This compares with the 427 comparable properties that sold in May 2017. These numbers represent a 45 percent reduction year-over-year. Last year, the market frenzy served to drive high-end house prices to unsustainable levels. That stopped this year due to the three hikes in interest rates, and the restrictive stress testing imposed by the banks. It’s clear that these factors have had a strong psychological impact on buyers. They are waiting to see if the high-end market continues to fall.

Some argue that the instability caused by the trade wars, NAFTA, and the pending interest rate hikes will have a negative impact on the Canadian economy. Others think that we have a very strong economy and believe the real estate market will start its recovery later this year.

Navigating this uncertain market is difficult for the uninformed, and mistakes can be costly. If you have questions, I’m here to help. Reach out to me today: 416.566.7730 or susanbandler@chestnutpark.com. I’m happy to help you determine the best strategy for a successful move in this market.