Last April, the Ontario Government imposed The Fair Housing Plan, a 16-part set of regulations to bring an immediate cool-down to the Toronto real estate market. Its impact was felt for the remainder of 2017 and start of 2018. A year later, there are signs that the current policy-based volatility is coming to an end.

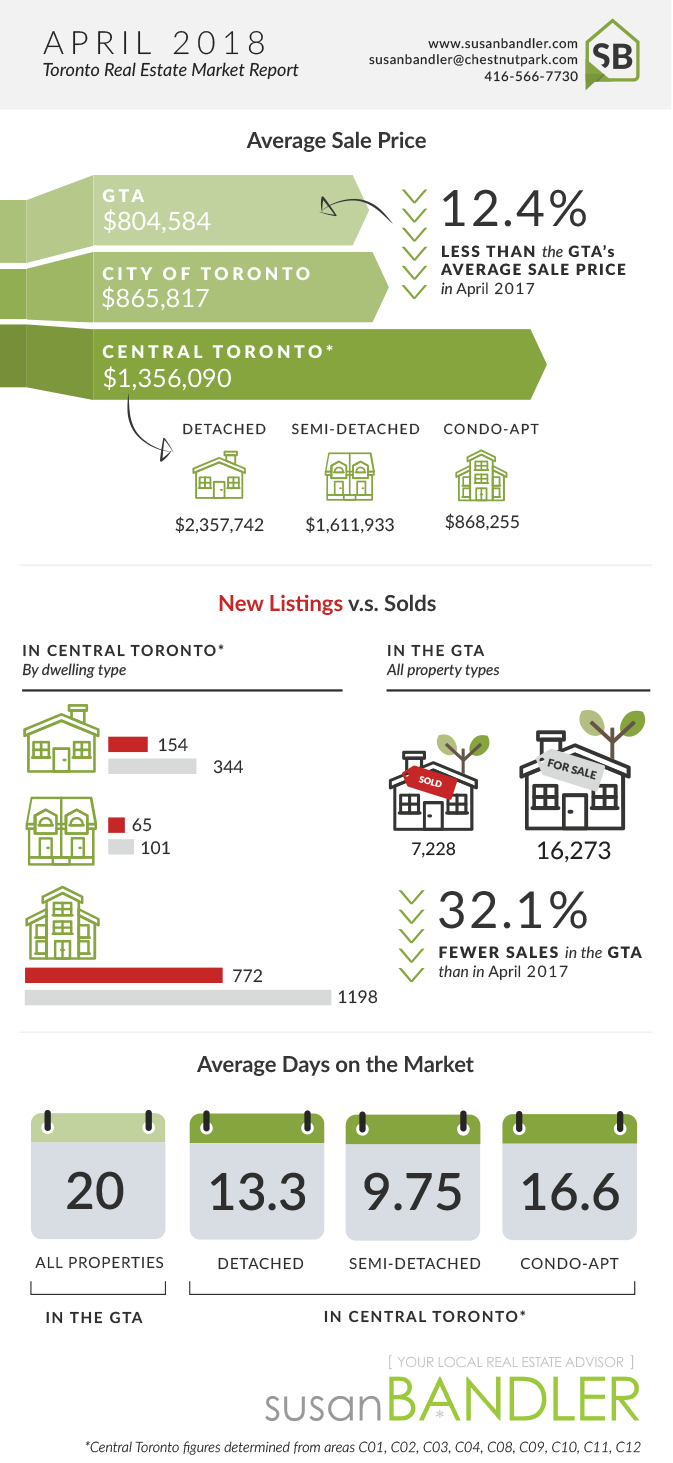

While average selling prices have not climbed back to last year’s record numbers, April’s prices represent a substantial gain over the past decade. For the fourth consecutive month, the market has shown improvement in both average sale prices, which have increased nearly 10 percent since the start of 2018, and the number of properties sold.

In April, the average sale price of all properties (including the condominium market) in the City of Toronto was $865,817. Of particular note is that April saw 16% more detached homes sell compared to March, and an average price increase of 4.7% ($1,354,719).

During the downturn, buyers enjoyed balanced market conditions; a nice contrast to the bidding wars and runaway prices that plagued the last few years. According to Jason Mercer, TREB’s head of market analysis, these market conditions aren’t here to stay. He says, “market conditions should support moderate increases in home prices as we move through the second half of the year, particularly for condominium apartments and higher density home types.”

Looking to the future, there are questions about whether the Bank of Canada (BoC) will raise interest rates this week. There are two schools of thought:

Benjamin Rietzes, an economist at BMO, says:

“Since the new mortgage rules took effect on January 1st, home sales have fallen over 20 per cent … a tightening of B.C.’s foreign-buyer rules in mid-February is also weighing on activity…with sales yet to stabilize, it’s hard to imagine the BoC will opt to tighten policy further and increase the downside risk to housing.”

On the other side, Derek Holt, VP and Head of Capital Markets, lists solid income gains, balanced supply and demand ratios along with higher immigration, as reasons for a possible rate hike:

“Weakness in the Toronto region is partly offset by strengths elsewhere including Vancouver, and offset by expected strengths in other areas of the economy. A stronger housing market in southern Ontario is expected later in the year and into next year.”

The jury is still out… what do you think will happen?

This time of transition has seen a range of pricing strategies, some with logic and others with no rhyme or reason. This inconsistent market has made a few things clear. Firstly, patience is a virtue. It’s not the time to make any impulsive decisions as a buyer or seller. Secondly, if there was ever a time to have an experienced agent on your side, it’s now. Navigating this uncertain market is difficult for the uninformed, and mistakes can be costly – if you have questions, I’m here to help. Reach out to me at susanbandler@chestnutpark.com or 416.566.7730.