The Toronto Real Estate Board released its outlook for 2018. It points to a slower start than the record-setting pace we experienced a year ago. The pace of home sales is expected to pick up as the year progresses and home buyers get over the psychological impact of the Fair Housing Plan.

It is not surprising that home prices in some market segments were flat or down this January compared to last year. In 2017, we were in the midst of a housing price spike driven by exceptionally low inventory in the marketplace. Remember those crazy few months we had when the market spun out of control? It’s not likely that we’ll see that frothy market again. So for the coming months to mid-April, the comparisons, year-over-year, need to be evaluated with last year’s “out-of-whack” market in mind.

It would be natural to focus on the sharp 22 per cent monthly drop in home resales in January. But even more noteworthy is that this happened as new listings plummeted to an eight-year low. This drop suggests that the sales slowed down due to a lack of homes being put out for sale.

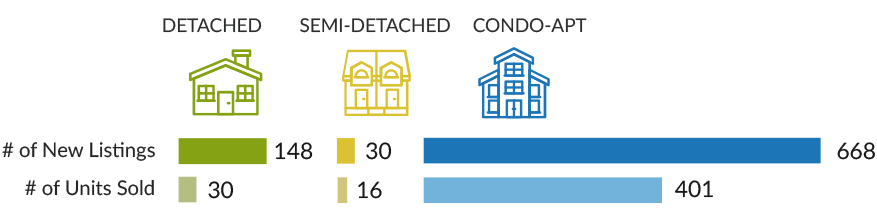

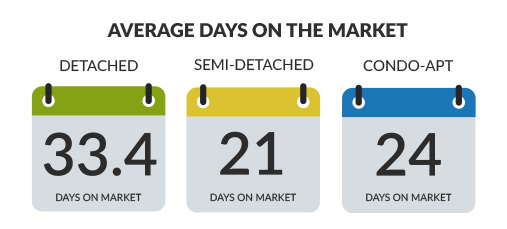

{TORONTO BY THE NUMBERS}

{TORONTO BY THE NUMBERS}

Central Toronto Districts C01, C02, C03, C04, C08, C09, C10, C11, C12

The market for detached housing is still absorbing the measures implemented by the provincial government, while Toronto’s condo market has remained hot.

In comparing these January results to December of 2017, we need to consider the big run-up of activity we experienced late-2017 as buyers tried to get ahead of the new [mortgage] rules. December 2017 saw activity like never before. Buyers were desperate to have an accepted Agreement of Purchase in their hands before year-end to avoid the new approval process that requires buyers to qualify for a mortgage at 2 basis points higher than the going rate.

Now that we’ve analyzed the historical numbers, let’s look at the current ones. Over the past couple of weeks, I’ve seen a flurry of market activity including multiple offers in all price ranges, and homes with price tags upwards of $2.5 mil selling in just one week.

So is the market going up or down? The answer is… there are mixed signals. The new stress test is affecting a small portion of the buyers – approximately 15%. The rest of the buyers, in all snack brackets, have not been discouraged by the stats and are in buying mode. If you have a house to sell, the limited inventory makes it an ideal time to list. If you’re thinking of doing so, I’m happy to get you started down that road.

As always, if you’ve got questions, please feel free to reach out to me today: 416-566-7730 or email me.