If you’ve been following my recent blog posts and newsletters, you’ve heard that Canada has adopted new mortgage rules. For those of you that are still unclear of the details, let’s walk through them.

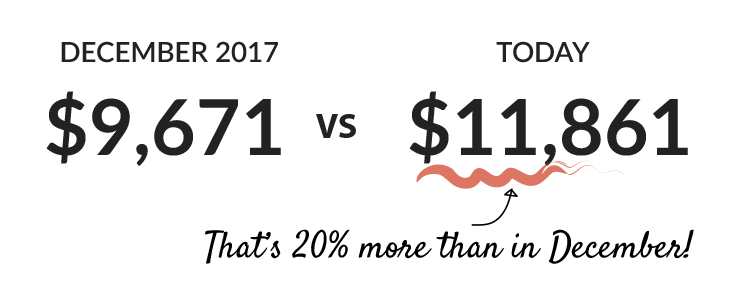

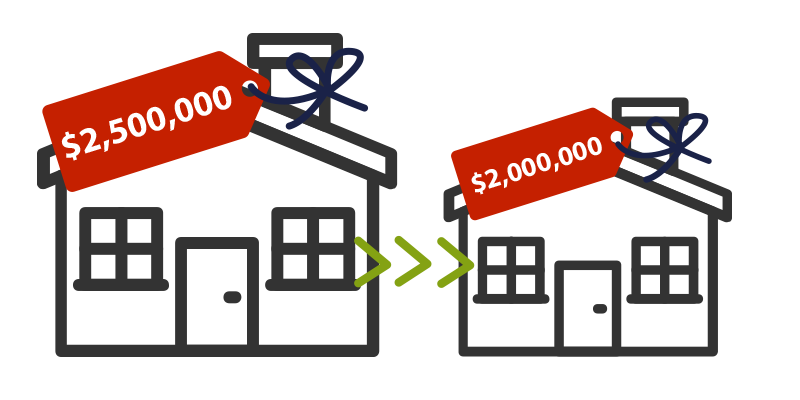

Despite having enough equity for a new home, buyers may not qualify for a mortgage because their incomes are insufficient to meet this new stress test. For illustrative purposes, consider a house that’s listed at $2.5M. While the mortgage payments remain $9,671 per month – the buyer must qualify for a mortgage as though the payments would be $11,861 per month.

If this is the case, buyers will have to adjust their budget to reflect a sale price with a mortgage they can qualify for…that might mean up to 20% less than the original budget.

To add fuel to the fire, the Bank of Canada raised the overnight rate to 1.25 percent last week. Combining this rate hike with the mortgage stress test, it certainly looks like buyers may delay purchasing decisions.

If the market does cool down in the first few months of 2018, it isn’t likely going to stay that way for long. Housing demand, low unemployment, strengthening wage gains, aging millennials and increased immigration are all fundamentals in place to improve our economy, and ultimately contribute to stable market growth.

Toronto average price growth is forecast to remain positive, albeit more subdued in the low single digits.

If you’ve got questions, I’m here to answer them. Reach out to me today: 416.566.7730 or susanbandler@chestnutpark.com. I’m happy to help you determine the best strategy for a successful move in this market.

{TORONTO BY THE NUMBERS}

{TORONTO BY THE NUMBERS}

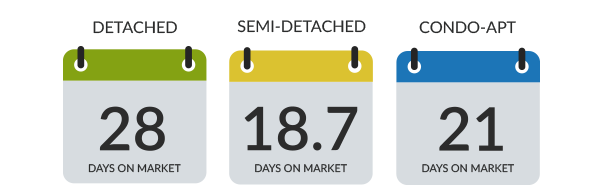

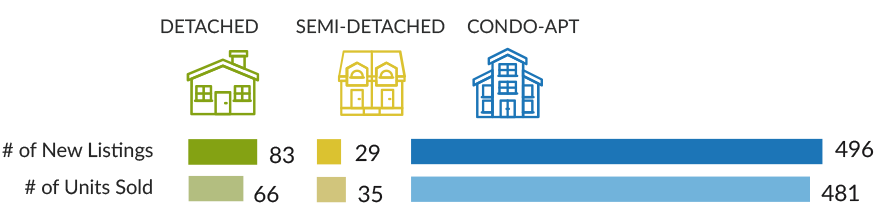

The average sale price and number of sales reflect the total change from January 1, 2017 to December 31, 2017.The numbers referenced below are specific to December 2017.

{FROM MY BLOG}

{FROM THE BLOG}

Canadian Tech is Slashing Energy Bills

The Canadian Innovation Awards are underway and two of this year’s nominees in the Energy and Sustainability category are working to save money for home owners! Read More