What a year it has been. No one expected 2020 to bring out so many emotions in all of us. Some were good, and some weren’t so good. We didn’t always know what to do, but we learned. We even managed to enjoy the rhythm in routine and perhaps even discovered new ways to do things. It’s the story of our species – we adapt. The residential real estate market adapted, as well. It surprised us all, including the many economists who warned of a downturn that has yet to arrive. Looking back on the last 12 months, some interesting data comes to mind…

1. Forecasters predicted that house sales would drop 29% and not rebound until the second quarter of 2021. In reality (and on a national basis) sales are up by 9% and the average sales price has increased by 12%!

2. The Canadian Dollar was expected to decrease to $0.66 compared to the US Dollar. Today our dollar is hovering around $0.78 compared to the USD. We’re rebounding.

3. The GDP was expected to plunge by double digits. As it turned out, we saw a decrease of 5%.

4. There were predictions of a stock market crash. Those rumours were exaggerated. It’s been a good year and the momentum shows no signs of letting up.

5. Economists predicted fewer housing starts until late 2021. They were wrong. The record shows close to 200,000 new units were built by the end of November.

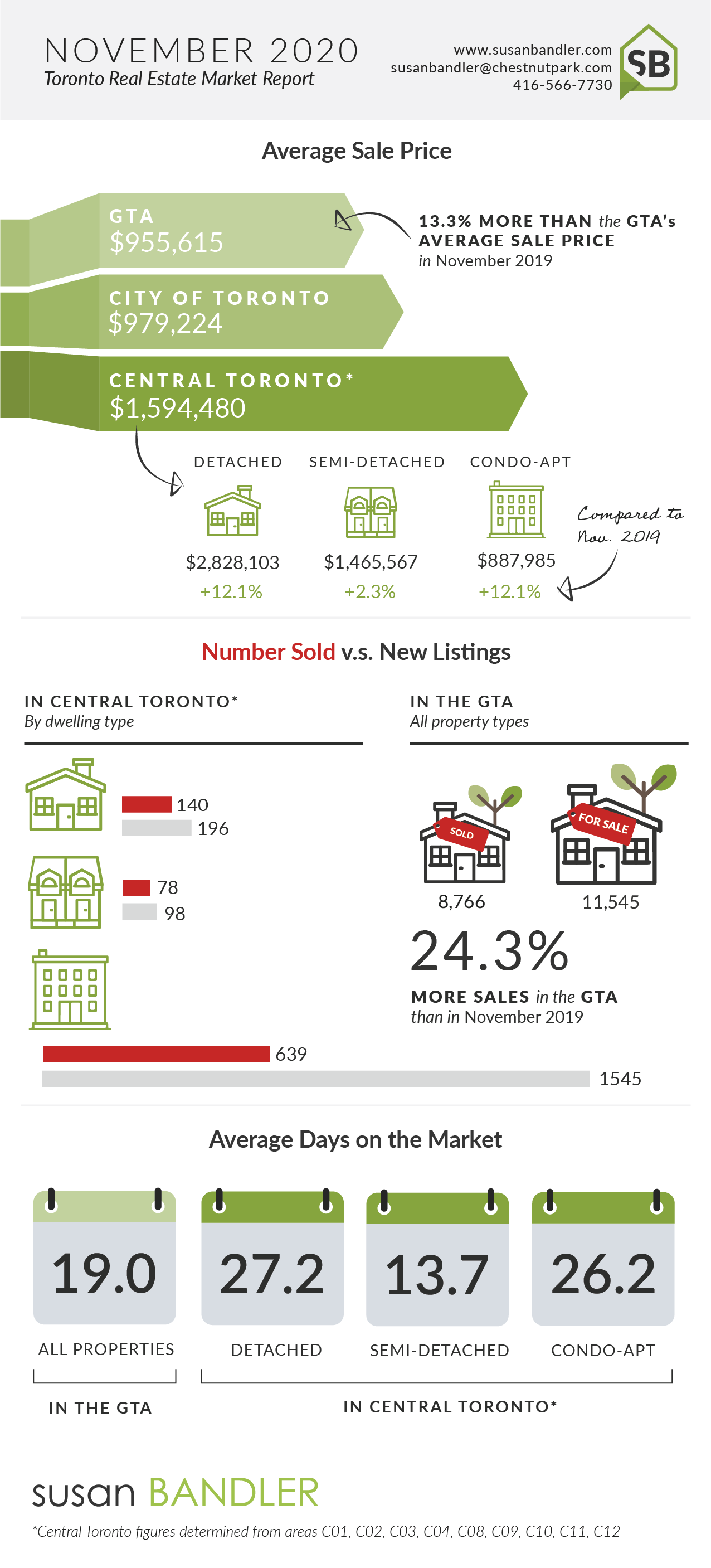

On a micro-level, the 416 continued to roll along and surpassed a very strong 2019. Sales this past month were up by 11% with 3,030 transactions compared to 2,718 sales in 2019. The November Average Sale Price increased by 7% from $910,000 (2019) to $973,000 (2020).

What does all this mean for 2021? Well, I’m (cautiously) expecting clear-sailing. The housing market should stay strong based on low interest rates, liquidity and affordability. The future shows good potential.