Hurray… the warm and sunny weather has never been more welcomed than it is now. I hope this newsletter finds you well, healthy and perhaps slightly tanned! Vitamin D keeps us happy!

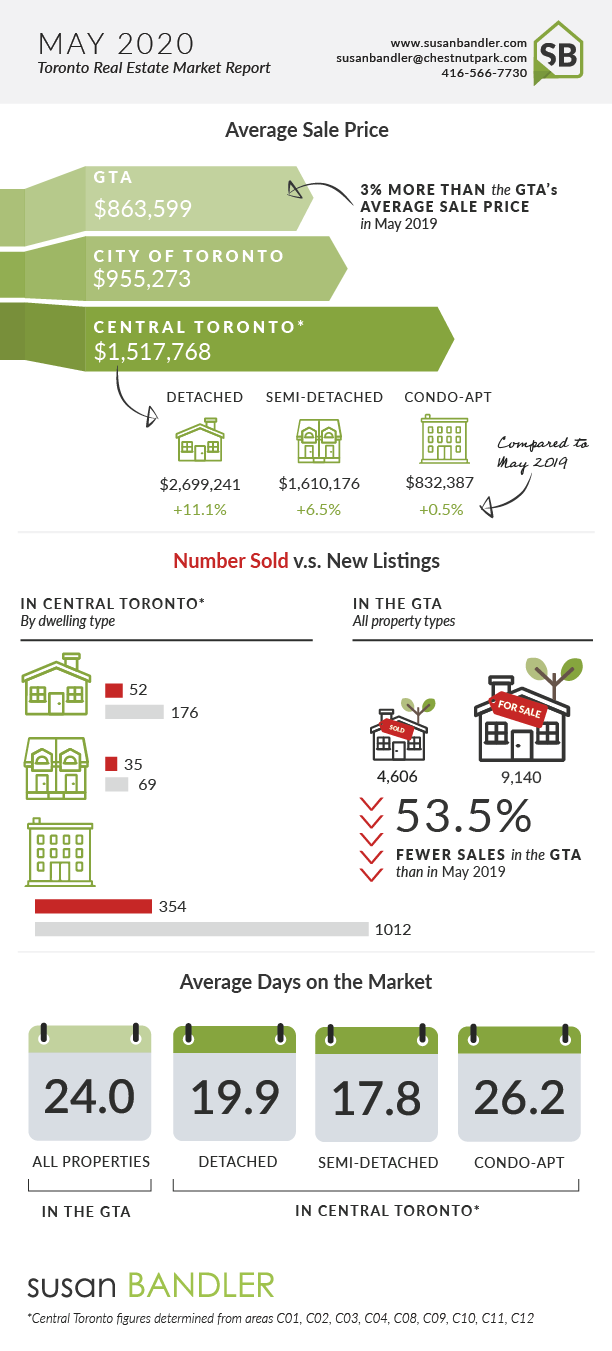

These past two months have seen a surprisingly active real estate market. Perhaps our expectations have been low. After all, very few expected the market to be as active as it is at this point during the pandemic.

Most of us have been taking COVID one day at a time. And in that context, Toronto real estate is improving steadily as the summer days go by. Will the trend last for months or years? No one knows. Just as no one knows how long the pandemic itself will last.

The month of May did its part to help the rebound with increases in both sales and listings, and now June appears to have kept up the momentum for a return to pre-COVID numbers.

With sales traditionally slowing down through July and August, and Toronto real estate possibly enjoying a “delayed-spring” this year, it’s possible that Summer 2020 could bring the market to a historically strong comeback. Albeit, it began with the worst spring market on record.

Meanwhile, the buyers and sellers are confident again, and the bidding wars and bully-offers have returned after a 2 month pause.

The federal government extended the Canadian Emergency Relief Benefit (CERB) for another two months, with the scheduled end date now pushed back to early September. It also increased the maximum period that one can receive CERB payments from 16 weeks to 24 weeks. Stephen Brown, economist from Capital Economics wrote, “this will allow for a stronger recovery than previously anticipated.” But even in his relatively upbeat take, Brown said that household income is likely to fall – eventually – as employment will remain lower than its pre-pandemic level.

When it comes to the anticipated shift from balanced conditions to a buyer’s market for Canadian real estate, RBC economist, Robert Hogue, predicted that the timing will be different depending on the market. “We expect the increase in supply to tip the scale in favour of buyers in many markets across Canada, some sooner than others”. He also predicted a seven percent decline in benchmark home prices from pre-pandemic levels by mid-2021. However, he wrote, “a widespread collapse in property values is unlikely.”

Predictions from the 2 above economists:

- Investor interest in major Canadian real estate markets is waning.

- The second half of the year will see prices struggling.

- Low levels of immigration (another byproduct of the pandemic crisis), and an elevated unemployment rate will likely curb the rebound in the housing market.

I always take the “glass half-full” view, so here it is.

The 416 does not represent the entire country, and the Toronto real estate market doesn’t seem to be adhering to many of the forecasts and predictions being put forward right now. Long-term, this market has a lot going for it, the whole world-class city thing, it’s still a desirable city to live in – if people have long-term horizons, my hope is we’ll all get through this with a few bruises, but relatively unscathed.

If you are planning on selling in the fall or early next year, my recommendation would be to get your house on the market sooner rather than later, so that you optimize your price. Who knows, if your plans are to buy something else, you may get lucky by selling high and buying lower. That would be a score!