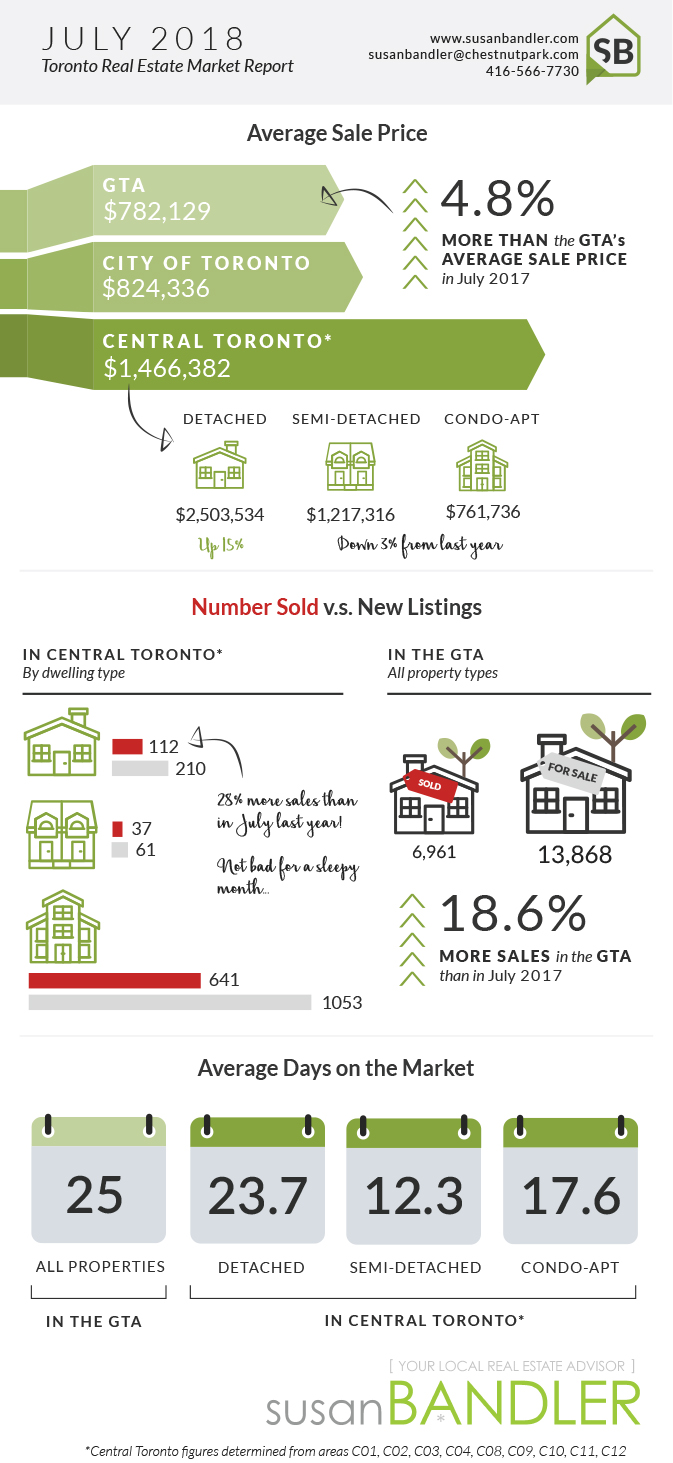

July represented a second consecutive month of both increased activity and sale prices for Toronto real estate. The market is certainly climbing out of the hole created by government policies from last year. However, the 2018 18% rise in sales over July 2017 still represents a 30% decline from two years ago.

It doesn’t look like the market is ready to return to the record highs of Spring 2017, and there are two main reasons for this:

Interest rates are on the rise. Relatively flat prices suggest fiscal policy is impacting the housing market. The Bank of Canada hiked the overnight rate 1.5 basis points in July and may impose another rate hike in the 4th quarter based on Canada’s steady population growth driving the economy.

The dampening effect of the mortgage stress-test has prevailed longer than anticipated. These new policies have made it more difficult for the already disadvantaged millennials to buy their first home. Equally affected are those looking to move up in the $2MM+ price range. The damper should taper off over time, but until then, sellers will need to realize listing prices need to be realistic if they want to sell.

Despite these downward forces, the Toronto real estate market is sitting on positive fundamentals: low unemployment, rising incomes, population growth, and an economy that’s running at capacity. These factors pave the way for 2019 to see a slight increase in resales. Less optimistically, Robert Hogue, RBC senior economist, is predicting that interest rates for the coming year will keep housing activity below the 10-year average.

Is it an optimal time to sell? Probably not, but life happens and we can’t always hold our breath waiting for the market to recuperate. If you have questions about optimizing the value of your house in this market, I’m here to answer them. Reach out to me today: 416.566.7730 or susanbandler@chestnutpark.com.