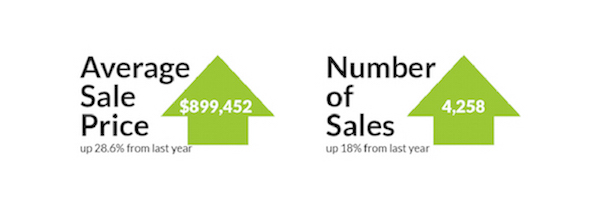

Now let’s get down to business with the big news in the Toronto real estate market. The Ontario government finally intervened to try and normalize the market. But, does the 16-point plan address the imbalance between supply and demand? Before April 20th, the market was driven by aggressive sellers, panic buying and the fear of missing out (FOMO). This combination of factors fuelled a serious imbalance between buyers and sellers and sent prices skyrocketing. The average price of a Toronto house increased almost $200,000 – from $699,000 to $899,000 – in a year. If there’s a silver lining it’s that the number of new listings (for semi and detached homes) has risen by over 50% since February. But that is still not enough to meet the demand.

It will certainly be interesting to see if the new measures will help to level the playing field, or will these changes lead to unintended outcomes?

The Ontario Fair Housing Plan is an omnibus package of measures intended to help more people find affordable homes, protect buyers and renters, and bring stability to the real estate market.

The highlights include:

- – A 15 percent non-resident speculation tax on the price of homes in the Greater Golden Horseshoe (view map).

- – The expansion of rent control to include buildings built after 1991.

- – The development of a standard residential lease.

- – A program that leverages the value of surplus provincial land to develop affordable housing.

- – A vacant homes property tax.

- – Policies to ensure that property tax on multi-residential buildings is fair.

- – Development charge rebates to encourage the construction of rental accommodation.

In addition to these measures, the government announced that it would study and evaluate:

- – Assignments, ie. the practice of paper-flipping.

- – Double-ending, ie. transactions wherein a broker/salesperson represents both the buyer and seller.

- – A revised partnership with Canada Revenue Agency to explore more comprehensive tax reporting requirements.

There is no doubt that expanding rent controls will immediately limit the rent increases that landlords can implement. Unfortunately, this measure could exacerbate the current rental housing problem if developers stop building purpose-built rental projects. It’s also entirely conceivable that developers could reconsider condominium projects intended to appeal to landlord-investors.

The Foreign Investor Tax could accomplish its goal of reducing the volume of purchases made by non-residents. On the other hand, savvy investors will inevitably find ways to work around the governing criteria and marginalize the impact of this legislation. Moreover, there is ample evidence that the GTA residential resale market is driven by domestic, and not foreign investors. If this is the case, then we can expect a short-term lull in buying to be followed by a return to the frenzied market the tax was intended to correct. This is what happened in Vancouver where the market came to a grinding halt that lasted a year before returning to its former frantic state.

This market is driven by three factors: historically low mortgage interest rates; 100,000 net migration annually to the GTA; and a lack of housing supply. The government’s new plan does not address any of these drivers. So, if the ultimate goal is to make housing in Ontario more affordable, the Plan will fail. Even the extension of rent controls will result in rental housing problems in the long term.